Why AR is the ultimate weapon for the locked down beauty industry

With traditional retail environments locked down for much of the last 12 months the beauty industry has had to adapt. Charlotte Willcocks, Strategy Director at Impero, argues that with the sector continuing to embrace augmented reality, that's exactly what it has done.

For the past 12 months the beauty industry has faced a huge challenge.

As a category based largely on a tactile and sensorial product experience - usually served with a side-order of elevated, in-store experience - it saw its main levers of communication removed almost overnight.

How do you launch a sensorial skincare product when touching anything is largely off the table?

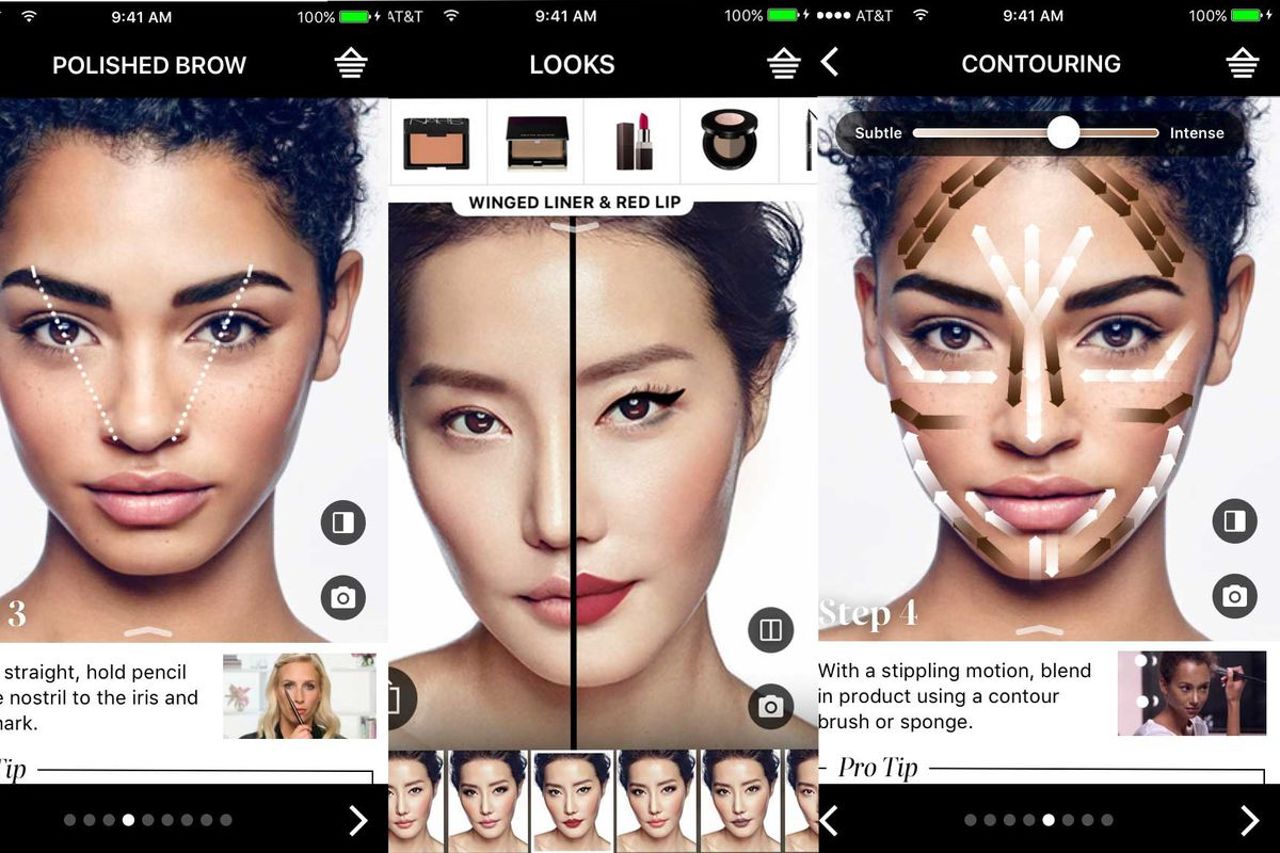

Adoption of augmented reality (AR) within the category started as far back as 2017, used to support the shift in consumer buying power to online, with L’Oreal pioneering technology to support their professional hair colour brands. This was followed in 2018 by the ModiFace app, which supported NYX, the make-up side of the business. It’s fair to say that, even at that point, AR was still considered a nice to have ‘add-on’ to many marketing plans and launch strategies. The functional application of the technology still made it difficult for brands outside of make-up and hair to find a home for it.

Above: The ModiFace app was an early example of the beauty industry successfully utilising AR.

That was until 2020, when all launches across the category were put into jeopardy. How do you launch a sensorial skincare product when touching anything is largely off the table? This is where AR as a secret weapon to the category became clear. AR had gone multi-sensory. Until that point, the application of AR was to educate consumers (which lipstick suits me? Could I be a blonde?) but consumers wanted more, they wanted the in-store experience at home. They wanted to see the texture of products, understand and immerse themselves into the brand story, and be able to purchase the product at the click of a button.

Until [2020], the application of AR was to educate consumers but consumers wanted more, they wanted the in-store experience at home.

This improved consumer journey led to skincare brand Dr.Jart+ being able to conduct their UK market launch without a single physical store being open. They used AR to tell the brand story, highlight the product texture, educate on unknown product ingredients and show efficacy, all through an end-to-end, immersive AR experience. And the results? Over 10K consumers engaging with the AR portal since launch.

Not only that, a recent Shopify report stated that interactions with products having AR content showed a 94% higher conversion rate than products without, proving that AR has finally found it’s feet with solving real consumer pain points. So much so that 51% of consumers state AR as the top technology to help them access products. But this is a response to now, when our retail options are seriously reduced. What happens when the world opens up again?

Above: Skincare brand Dr.Jart+ conducted their UK market launch via AR, without any physical store being open.

If history is anything to go by, consumers are going to need some encouragement to get them back to brick and mortar stores. Even after the second UK lockdown in November last year, footfall was still down 29% YoY. Brands will now be under pressure to create a seamless digital journey while making the in-store experience something worth travelling for.

Moving AR from a functional gimmick to a fully immersive experience was always going to be a challenge.

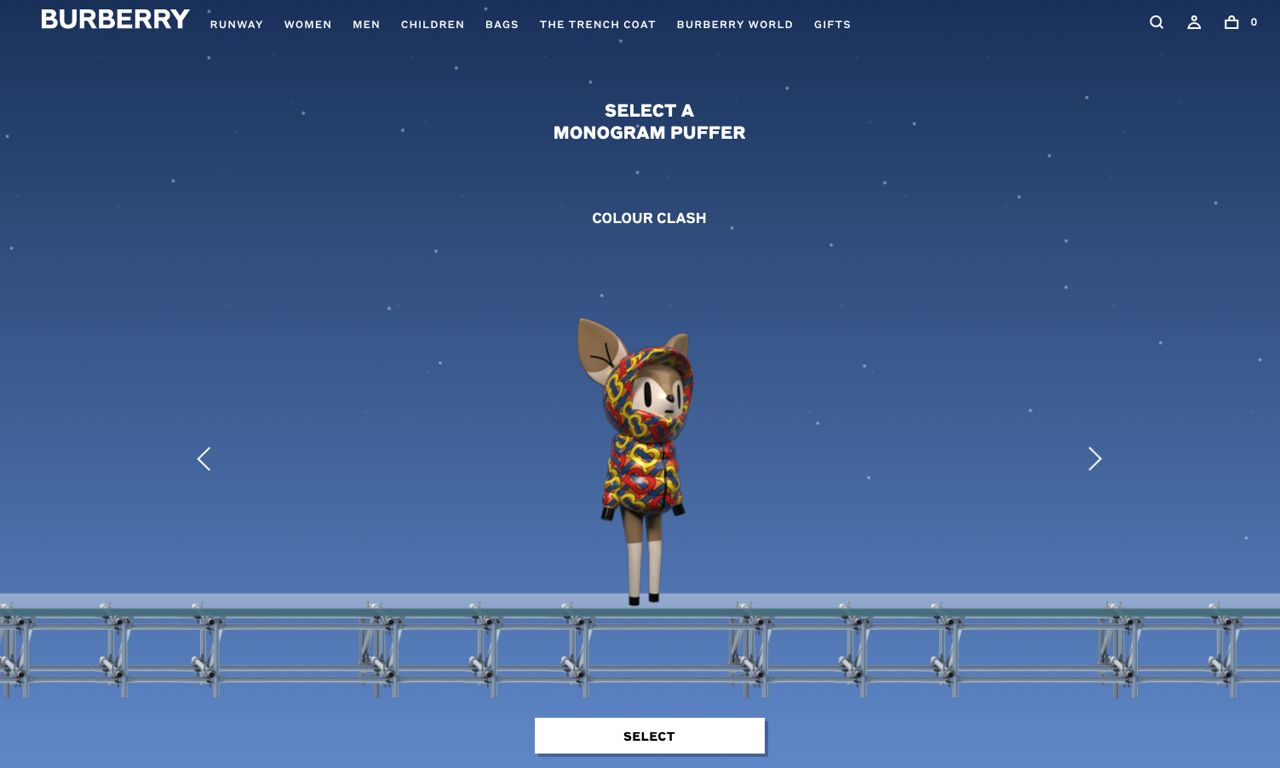

Brands like Ulta are already leading the way, with touch-free product sampling via their AR beauty tool, GLAMlab, seeing huge success with over 50 million shades of foundation being digitally switched since the pandemic began, and with clear expansion opportunities for in-store too. Then there’s Squadded, an online, co-watching video app where friends can shop together, which is already working with brands such as Burberry to reimagine the shopping experience between the real and virtual worlds.

Above: Burberry's platform game.

Which leads to the most exciting emerging area of AR; gamification. Moving AR from a functional gimmick to a fully immersive experience was always going to be a challenge, which is where consumer participation comes in; from Burberry creating their own game, to Louis Vuitton experimenting with how they can turn their flat, visual merchandising and collections into a gamified digital objects that can be bought, collected and used on gaming platforms by consumers. Consumer spending on gaming loot boxes and skins worldwide is predicted to hit $50 billion (USD) by 2022, cementing AR’s position in the marketing mix long after lockdown lifts.

[Covid] has accelerated engagement in digital worlds, increased overall consumer digital literacy and provided a real user case for AR.

Will AR be the secret weapon with staying power? From around 2009 it’s appeared in every trends-to-watch report, declaring ‘this is definitely AR’s year!’. It’s almost at industry trope-levels of disillusionment. But that was before the year of discontent that was 2020. Covid has changed how we will shop and interact for years to come. It has accelerated engagement in digital worlds, increased overall consumer digital literacy and provided a real user case for AR. From brand storytelling and education during the purchase journey through to breaking new ground with the monetising of digital products, AR has proven its ability to add value in the most adverse of environments and finally earned its place as a core component to marketing to the next generation of consumers.

)

+ membership

+ membership